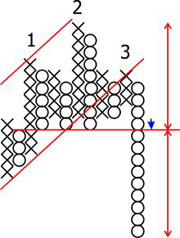

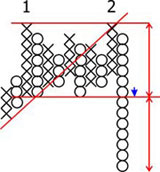

| Head and Shoulders The head and shoulders pattern is found in candlestick, point and figure, and chart patterns and is considered one of the most reliable reversal patterns. The price forms a high on column one, followed by a period of consolidation. A second high is created followed by another period of consolidation, the right shoulder is then formed followed by a sell off. High volume should be seen on the last downward move. Parralel support and resistance lines can be drawn as well as a visible neckline. The height of the highest high should give a projection of the drop of the final downward move. |

|

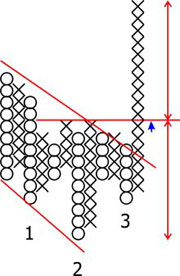

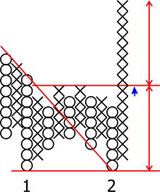

| Inverted Head and Shoulders Pattern The inverted head and shoulders pattern is found in candlestick, point and figure, and chart patterns and is considered one of the most reliable reversal patterns. The price forms a low on column one, followed by a period of consolidation. A second low is created followed by another period of consolidation, the right shoulder is then formed followed by a buy signal as it crosses the neckline. Parralel support and resistance lines can be drawn as well as a visible neckline. The height of the lowest low should give a projection of the strength of the upward move. |

|

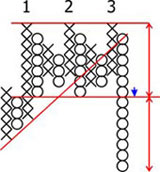

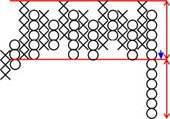

| Triple Top The triple top is a variation of the head and shoulders pattern. This pattern consists of three peaks of similar height. After the third peak is formed and the price movement breaks the neckline, a bearish signal is given. The expected drop should be of similar height as from the neckline to the tops. |

|

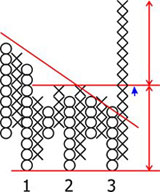

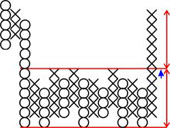

| Triple Bottom The triple bottom is a variation of the inverted head and shoulders pattern. This pattern consists of three lows of similar height. After the third low is formed and the price movement breaks the neckline, a bullish signal is given. The expected rise should be of similar height as from the neckline to the low. |

|

| Double Top The double top is a variation of the triple top pattern. This pattern consists of two peaks of similar height. After the second peak is formed and the price movement breaks the neckline, a bearish signal is given. The expected drop should be of similar height as from the neckline to the tops. It is important to note that before the price drop, the trend line is broken. |

|

| Double Bottom The double bottom is a variation of the triple bottom pattern. This pattern consists of two lows of similar height. After the second low is formed and the price movement breaks the neckline, a bullish signal is given. The expected rise should be of similar height as from the neckline to the tops. It is important to note that before the breakout, the trend line is broken. |

|

| Bearish Rectangle Reversal The uptrend forms a clear period of consolidation, the support line is then broken on a heavy volume day, it is at this point where the bearish signal occurs. |

|

| Bullish Rectangle Reversal The downtrend forms a clear period of consolidation, the resistance line is then broken on a heavy volume day, it is at this point where the bullish signal occurs. |

|

Source:

ChartFilter.com

Newest comments